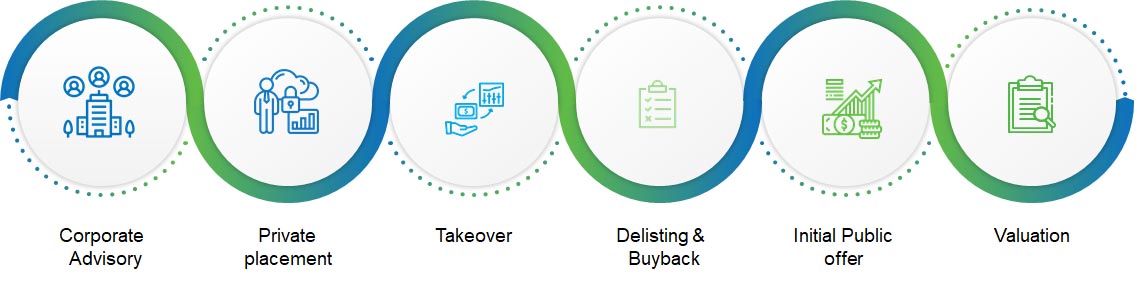

It is one of the most important essence during the perpetuity of a Company be it public, private or a listed entity. All capital restructurings are result of corporate advisory and planning. We at Sumedha, have had the track record of providing successful business planning, business valuations, inbound and outbound restructuring services, tax efficiencies for both direct and indirect taxes etc. We believe with this changing times and digitization, providing innovative solutions and ideas is the key point in helping the corporates survive and adapt to the new changing times with the maximization of shareholders wealth.

Sumedha is a full fledged investment bank with a broad range of capital raising. Our Investment Banking team offers rich expertise in handholding issuers who are interested in wealth creation, finance growth, unlocking the value of the Company. We have strong presence among the Investors community who are day in day out in interested in investing in the company. We have introduced many corporates to the investors, thereby enabling them in unlocking their value.

At Sumedha, we are specialized in providing assistance to our clients in providing private equity by introducing the Company to Institutions, HNIs, fund houses and private equity players who are interested in investing in the Company in the seed stage. Private equity is the mechanism in which the equity shares of the Company are offered to pre identified investors privately rather than offering to the public at large. Companies usually prefer this route as this is a faster route for arranging funds without any approval and less regulatory requirements than the Public Offering.

Changing hands among the listed corporates is normal during the life of a business concern. Sumedha- being a SEBI Registered Merchant Banker is specialized in advising companies in changing hands and arranging for new buyers and investors who are interested in acquiring and running the business. We are specialized in studying the business and carrying out Due Diligence to ensure that the process of changing hands is done within the regulations specified by the SEBI.

The process of delisting the equity shares of the Company from the nationwide trading terminals is known as Delisting. SEBI has prescribed proper procedure for providing Exit opportunity to the public shareholders at the value as prescribed by SEBI. Sumedha is specialized in handling such assignments and has successfully assisted the corporates who do not wish to continue with their listing at the Stock Exchange to get the same delisted.

The process of buying back equity shares from the public shareholders is known as Buyback and as per the SEBI (Buyback of Equity Shares) Regulations, a SEBI Registered Category I Merchant Banker is required for the execution of the Buyback. At Sumedha we have a specialized team engaged in advising the companies for undertaking the Corporate Restructuring.

Valuations are vital component for nearly all financial and business transactions, requiring a high degree of practical, technical, and professional expertise. The increasing scrutiny of fair value certificates has amplified the necessity for reliable valuation opinions. In fact, many accounting and financial reporting regulations mandate valuations to be carried out on an ongoing basis. Moreover, valuations play a pivotal role in Compliance, Tax Planning, Litigation, Audit, and other strategic corporate planning decisions.

As Category I Merchant Banker Sumedha Fiscal provides the following valuation services:

- Valuation for Business Combination and Strategic Purposes

- Business Valuation

- Valuation to Support Transaction

- Valuation of Financial Instruments

- Fairness Opinion

- Intangible Asset Valuation

- Valuation Related to Litigation and Arbitration

- Valuation for Compliance and regulatory Purpose

- Valuation Under Income Tax Act

- Valuation Under FEMA Regulation

- Valuation Under certain the Provisions of SEBI Regulation

- Stressed asset valuation for Banks (Enterprise Valuation)

- ESOP (Exercise of Options & SEBI-Issue of Sweat Equity)